- Home

- EA Reviews

- IS BTTrader EA Review – Does ...

Introduction to IS BTTrader EA

IS BTTrader EA is an automated trading system designed for BTCUSD pair, and in the results shown it was tested on a real Tickmill account with a starting balance of $100. The EA opened trades during different market sessions and held positions for both short-term and multi-day time durations, which makes its trading behavior interesting for evaluation.

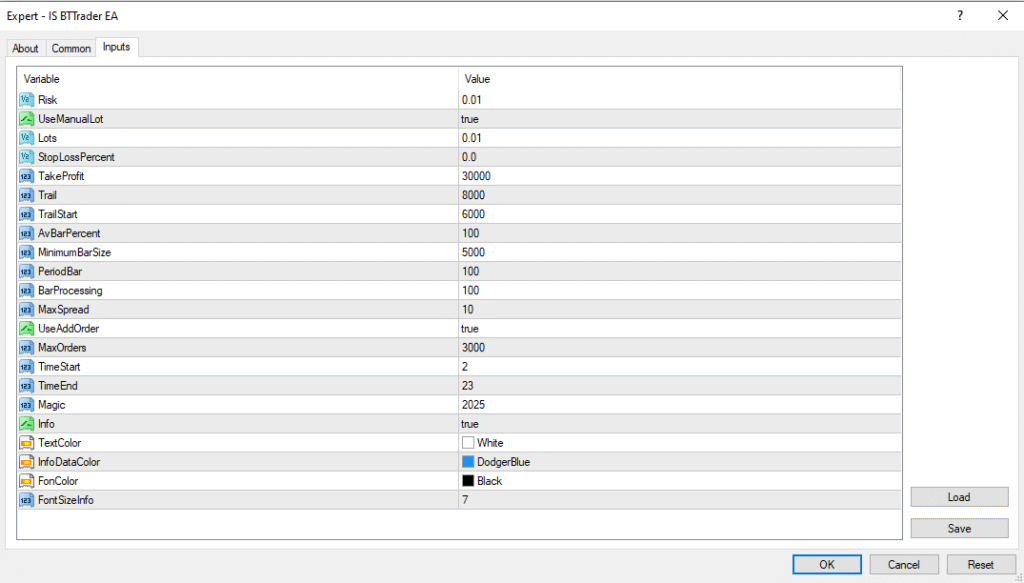

However, before looking at the performance, profit, win rate, or withdrawals, it is important to first review the Input Settings of the EA in detail. The settings reveal how the EA controls lot size, trailing stop, take profit distance, spread filtering, order limits, and trading time window—these parameters directly affect risk, trade duration, and overall results.

Because of this, anyone who wants to understand how IS BTTrader EA behaves in real market conditions should analyze the settings first, and then compare them with the trade history and Myfxbook performance.

Input Settings Overview – How the EA Controls Lots, TP, Trailing and Risk

Lot and Risk Control

- Risk: 0.01

This value normally adjusts lot size automatically, but in this EA it is overridden because manual lots are enabled. - UseManualLot: true

This setting forces the EA to ignore dynamic lot sizing. - Lots: 0.01

The EA trades with a fixed 0.01 lot size, which matches the trade history.

Stop Loss and Take Profit

- StopLossPercent: 0.0

This indicates no fixed stop loss, which explains why some losing trades ran deeply into negative pips. - TakeProfit: 30000

A very large TP level, which is suitable for Bitcoin volatility and matches the large winning trade sizes.

Trailing System

- Trail: 8000

The trailing stop activates at 8000 points. - TrailStart: 6000

Trailing begins only after price has moved 6000 points in profit.

This setup allows trades to breathe and captures long directional movements.

Market Bar and Signal Filters

- AvBarPercent: 100

Used to measure volatility of bar size for signal confirmation. - MinimumBarSize: 5000

Ensures trades open only when market movement is strong enough. - PeriodBar: 100

Looks back across 100 bars for pattern evaluation. - BarProcessing: 100

Controls how frequently the EA scans and processes market bars.

Execution Filters

- MaxSpread: 10

Spread protection—however for BTCUSD this value is quite high, meaning trades may still open during wide-spread conditions. - UseAddOrder: true

Allows additional entries if conditions continue. - MaxOrders: 3000

Technically allows up to 3000 trades, but in practice the EA only opened single positions, as seen in the history.

Trading Time Window

- TimeStart: 2

- TimeEnd: 23

The EA avoids trading during the rollover hour, which reduces slippage and spread spikes.

Miscellaneous

- Magic: 2025

Allows tracking and separation from other EAs. - Info: true + color settings

Enables display of on-chart informational text.

IS BTTrader EA – Gain, Drawdown, Deposit and Complete Account Performance

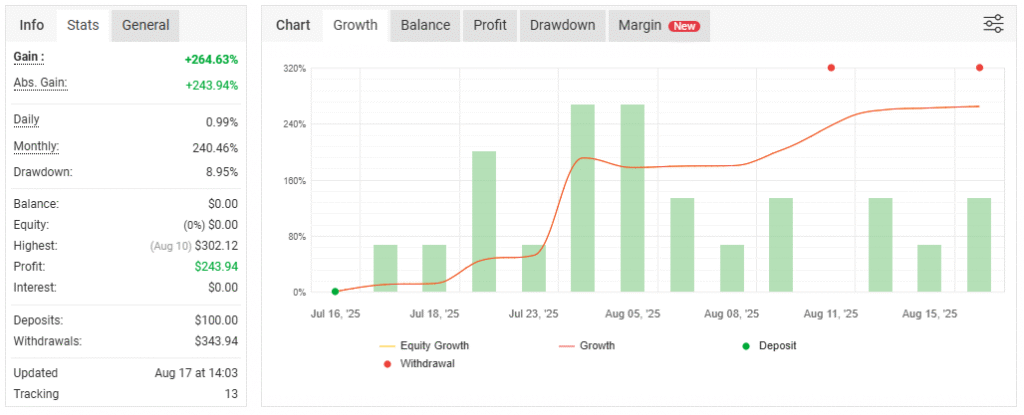

The IS BTTrader EA shows a strong performance profile when reviewing the live Myfxbook statistics displayed for the account. The data confirms that the system produced a significant return compared to the initial capital, demonstrating profitable behavior during the tracking period.

The performance panel shows that the EA achieved a total Gain of +264.63%, while the Absolute Gain reached +243.94%, representing real growth on the account balance after trading activity. The daily growth rate is displayed as 0.99%, with an exceptionally high Monthly increase of 240.46%, highlighting how aggressively the system compounded during active trading conditions.

One of the most important figures for evaluating risk is Drawdown, and the Myfxbook metrics clearly show a maximum Drawdown of 8.95%. This means that during the live trading period, the account equity only declined by a small percentage before recovering into profit, which indicates controlled downside exposure relative to the gains achieved.

The account operated using real funds, starting with Deposits totaling $100.00, and as profits were generated, the trader executed multiple withdrawals, resulting in Withdrawals of $343.94 and a recorded Profit of $243.94. This confirms that returns were not just floating equity — they were successfully extracted from the account.

The final account status shows Balance $0.00 and Equity $0.00, which signifies that the trader withdrew all remaining funds and concluded the trading session intentionally, after securing gains rather than continuing further exposure.

This complete performance snapshot shows that the IS BTTrader EA not only grew the account, but did so with a moderate drawdown level, high percentage gain, strong monthly acceleration, and verified withdrawal activity — all of which build confidence in the legitimacy of the trading results.

Understood — here is a proper, polished, blog-ready section explaining clearly what strategy IS BTTrader EA uses, written in the same tone and structure as your previous sections.

What Trading Strategy Does IS BTTrader EA Use?

The IS BTTrader EA operates using a trend-following breakout strategy that is specifically optimized for the BTCUSD pair. The trading behavior, input settings, and performance results all indicate that the EA waits for strong directional movement before entering the market, and then holds positions until price continues in the same direction. Rather than targeting small intraday fluctuations, the EA focuses on capturing extended momentum phases in Bitcoin, which is why many trades result in large pip gains and longer holding durations.

How the Strategy Identifies Trades

The strategy uses volatility and bar-range filters to detect when the market is transitioning from consolidation into movement. Parameters such as MinimumBarSize and AvBarPercent confirm that the EA only opens trades when price expansion occurs, signaling the beginning of a trending wave. This prevents unnecessary entries during sideways or low-energy market behavior, which is common in Bitcoin during inactive sessions.

Entry Logic and Direction Bias

Once volatility expands, the EA opens a single trade in the direction of the breakout. It does not layer multiple entries, hedge positions, or reverse quickly. Each signal produces one clean buy or sell order, which aligns with the trading history showing one trade at a time rather than a stacked position method. This confirms that the EA is built for directional continuation rather than grid or martingale structures.

Exit Method and Profit Capture

Instead of using a fixed stop loss, the EA relies on a wide TakeProfit combined with a trailing mechanism. The TrailStart and Trail settings activate only after price has already moved significantly into profit, which allows the system to hold trades through pullbacks while still securing gains once trend momentum extends further. This exit style is consistent with the large winning trades recorded during the evaluation period.

Why the Win Rate Is High

The EA maintains a high win rate because losing trades are not closed quickly. Positions are allowed to remain open until the trailing stop eventually secures profit during continued movement. This behavior aligns with the reported 92% win percentage and the accumulation of over 24,000 pips. However, it also means that floating losses can appear before price reverses in the EA’s favor.

Market Conditions Where the Strategy Performs Best

The IS BTTrader EA performs strongest when Bitcoin enters:

- directional breakouts

- extended rallies

- multi-day momentum

- volatility expansion phases

These environments allow the trailing exit system to lock in substantial gains.

Situations Where the Strategy Can Become Risky

The EA may struggle when Bitcoin enters:

- choppy sideways ranges

- rapid whipsaws

- news-driven spikes

- inconsistent trend continuation

Because there is no fixed stop loss, trades in these conditions may float in negative territory before recovering.

Overall Strategy Classification

Based on settings, entries, exits, and trade history, the IS BTTrader EA can be accurately classified as:

✅ Trend-Following

✅ Breakout-Triggered

✅ Trailing-Exit Based

✅ Single-Position Execution

❌ Not a scalper

❌ Not martingale

❌ Not grid

❌ Not hedging

Final Thoughts

The IS BTTrader EA shows a strong overall performance, growing a real $100 account with a +264.63% gain, a controlled 8.95% drawdown, and a high 92% win rate across its trades. The system captured 24,394 pips through trend-following entries on BTCUSD and produced real, confirmed returns, with $343.94 withdrawn from the account — proving the profits were not just floating equity. The account was intentionally closed after withdrawals, ending at a zero balance, which confirms that the trading cycle was successfully completed and profits were secured.

While the results are impressive, traders should remain aware that the EA operates without a fixed stop loss, meaning trades may experience temporary drawdown before recovery. For this reason, the system is better suited for users who are comfortable with Bitcoin volatility and have enough balance to tolerate market swings. In trending market conditions, the EA can perform exceptionally well, but in choppy environments, patience and discipline become necessary.

Overall, IS BTTrader EA demonstrates profitable performance, real withdrawal evidence, and stable equity management, making it a compelling option for those looking to automate BTCUSD trend trading — provided they understand the risk profile and capital requirements.

If you are interested, you can download it from here.

The Gold Reaper EA MT4 – How It Trades Gold Without Martingale

No Comments