- Home

- EA Reviews

- Evening Scalper Pro EA Review ...

This version of Evening Scalper Pro EA is configured to operate on multiple cross-pairs that behave more predictably during the evening and Asian trading hours. The pairs included in this setup are:EURNZD, EURAUD, AUDNZD, NZDCAD, AUDCAD, EURGBP, GBPAUD, and GBPCAD. These pairs generally offer smoother market conditions, lower volatility spikes, and better scalping structure during late-session trading, which aligns with the EA’s intended trading environment.

The EA is designed to run with a Minimum Deposit of $100, allowing traders with small accounts to operate it without requiring large capital. The recommended Timeframe is M5, meaning the EA reads price data and executes signals using five-minute chart structures, suitable for short-duration trades and tighter market movements.

Another important aspect is that the EA operates with No Martingale, ensuring that trade size does not increase after a losing position — a crucial factor for account safety and long-term sustainability. The configuration also uses SetFile: 2, which refers to a predefined parameter profile optimized for this multi-pair evening scalping setup.

Before moving further into performance observations and strategy breakdown, understanding these trading specifications helps establish what type of market environment, account size, and operational framework the EA is designed for.

👉 If you are interested, download it here.

Evening Scalper Pro EA – Input Settings Overview

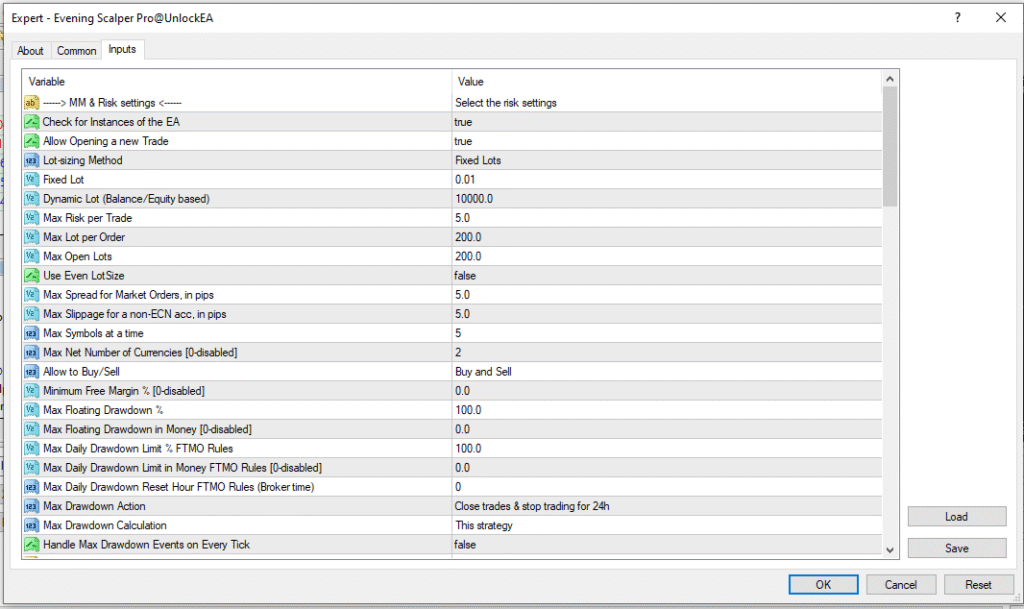

The Input Settings of Evening Scalper Pro define how the EA controls trade execution, manages exposure, filters market conditions, and limits operational risk. Each parameter contributes to how the system behaves in live environments, particularly during evening and Asian trading sessions where liquidity and volatility differ from London and New York hours.

1. Money Management Configuration

The EA is configured to operate using a Fixed Lot size of 0.01, meaning it does not dynamically adjust position size based on balance or equity. This ensures consistent trade volume and confirms that the EA does not apply martingale, grid scaling, or volume-based recovery models. The presence of Dynamic Lot options indicates scalability, but these are intentionally disabled, making the configuration suitable for smaller accounts, including the minimum recommended deposit of $100.

Additionally, upper limits such as Max Lot per Order and Max Open Lots are set to high values, serving only as safety caps rather than active restrictions. The EA also limits simultaneous exposure through Max Symbols at a Time and Max Net Number of Currencies, preventing correlated risk and avoiding over-concentration in currencies like AUD or NZD.

2. Drawdown and Risk Protection Parameters

Several built-in safeguards exist within the settings, including:

- Max Risk per Trade

- Max Floating Drawdown Percentage

- Daily Drawdown Protection (FTMO Compatibility)

- Automatic Trade Suspension on Limit Breach

These tools allow the EA to align with proprietary funding rules if required. However, because the thresholds are set to high percentages, the protective functions do not activate unless adjusted. This indicates that user-defined customization is encouraged for traders seeking tighter capital preservation or prop-firm compliance.

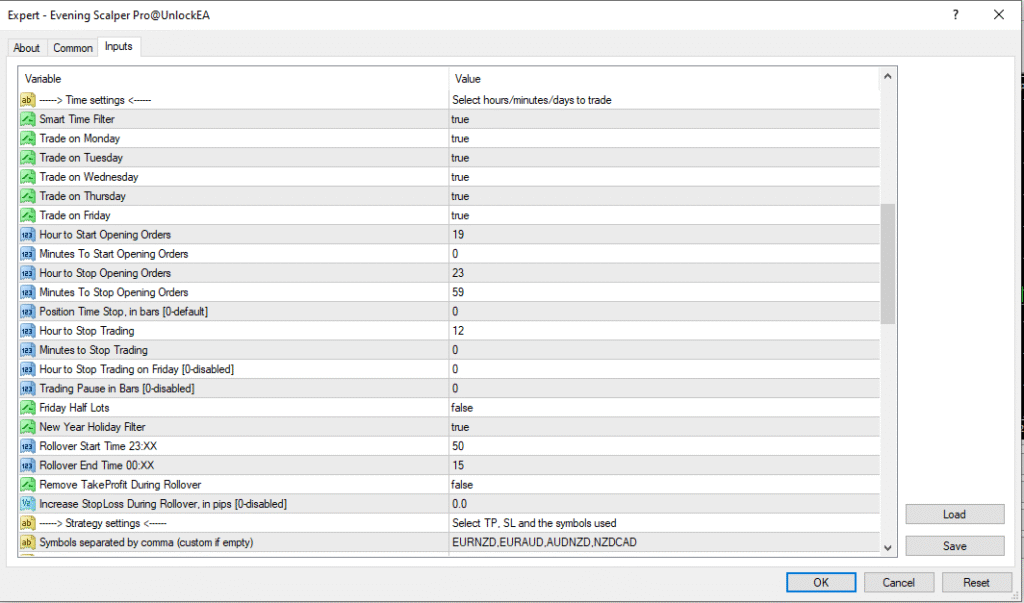

3. Trading Session and Time Filters

The EA is programmed to initiate new trades only between 19:00 and 23:59, positioning it specifically for evening and Asian session conditions. This timing aligns with reduced volatility, narrower directional impulses, and smoother price behavior on cross pairs. Additional time-based protections include:

- Smart session filtering

- Rollover avoidance

- Holiday restrictions

- Pre-midnight profit closure

These controls minimize exposure to swap spikes, liquidity gaps, and unpredictable price jumps that occur outside low-risk periods.

4. Symbol Selection and Market Exposure

The configuration supports trading across a diversified basket of cross pairs:

EURNZD, EURAUD, AUDNZD, NZDCAD, AUDCAD, EURGBP, GBPAUD, GBPCAD

These pairs historically behave more steadily during evening hours, making them suitable for scalping and mean-reversion behavior. Combined with exposure-limiting filters, the EA avoids stacking multiple positions tied to the same base currency, reducing systemic volatility risk.

5. Volatility, Swap, and Execution Filters

The EA integrates multiple protective market filters, including:

- Volatility filtering to avoid unstable price phases

- Swap cost filtering, especially on triple-swap days

- Spread sensitivity controls

- Automatic avoidance of unfavorable execution conditions

These components help maintain trade quality, execution efficiency, and risk moderation — essential characteristics for night-session algorithms.

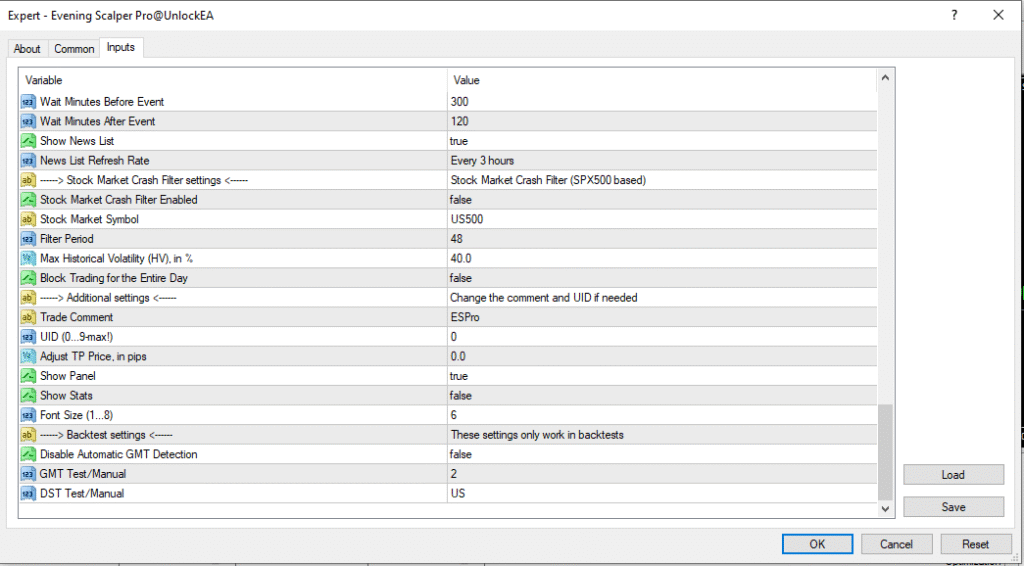

6. News Filtering and Event Control

The News Filter is enabled and configured to block trading around high-impact news releases, speeches, and FOMC-classified events. The extended waiting periods — five hours before news and two hours after — significantly reduce exposure to unpredictable spikes, slippage, and widening spreads commonly associated with macroeconomic events.

This reinforces that the EA prioritizes stability over aggressiveness, particularly during sensitive market periods.

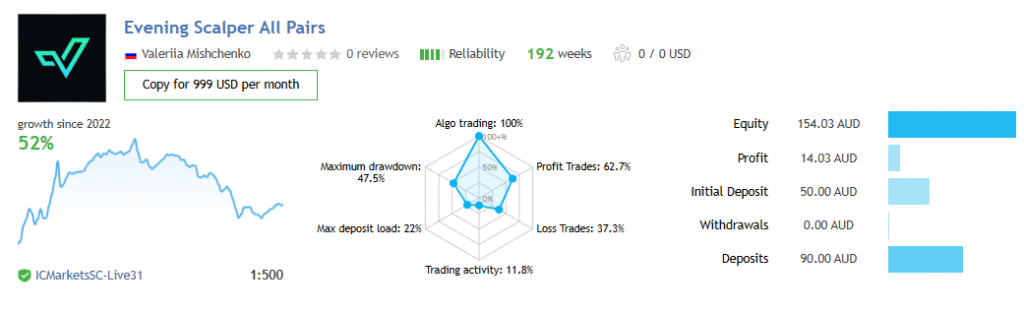

Evening Scalper Pro EA – All Pairs – Signal Performance Overview

The Evening Scalper Pro EA All Pairs signal has demonstrated steady long-term growth since its launch, showing a total Gain of 52% over its operational period. This reflects a gradual increase in account value rather than an aggressive compounding curve, which is typical of night-session scalping systems that prioritize controlled execution over high-risk expansion. The signal has maintained performance stability over an extended duration, highlighting that it focuses on consistency rather than rapid equity acceleration.

One of the key performance elements visible in the signal statistics is the Maximum Drawdown of 47.5%, indicating that the account has previously experienced deep floating losses before recovering back into profit territory. This confirms that the strategy does not rely on tight stop losses and allows trades to remain open during adverse movement until market conditions normalize. While the system eventually recovers, this drawdown level suggests that traders must have patience, emotional tolerance, and suitable account cushioning.

The financial breakdown shows that the signal was started with an Initial Deposit of 50.00 AUD, followed by additional funding of 40.00 AUD, bringing total deposits to 90.00 AUD. With no withdrawals recorded and a current Equity of 154.03 AUD, the account remains in a profitable state. The reported Net Profit of 14.03 AUD reflects realized gains excluding floating equity influence, reinforcing the slow-growth profile of the strategy.

Performance data further reveals a Profit Trade ratio of 62.7%, with Loss Trades at 37.3%, demonstrating a moderate win rate rather than a high-accuracy system. The signal operates with 100% automated algo trading, without manual intervention, and maintains 11.8% trading activity, meaning it does not execute trades continuously but instead waits for favorable low-volatility evening pricing structure.

Overall, this signal represents a conservative long-term scalping system designed for traders who prefer gradual growth, controlled automation, and measured exposure. While the strategy has proven sustainability across 192 weeks of operation, users must be comfortable with floating drawdown phases and should avoid expecting rapid profit accumulation. The signal is best suited for steady-paced traders, small account holders, and those who value longevity over aggression.

Evening Scalper Pro EA – Trading Strategy Behavior

By observing the trade history and performance characteristics of the Evening Scalper All Pairs signal, it becomes clear that the system is built around a night-session mean-reversion scalping concept. The trades are typically opened during the quieter evening market hours, when volatility is lower and price movements remain contained within narrower ranges. This environment allows the EA to capitalize on short corrective movements rather than relying on large directional trends. Instead of trend-following logic, the system waits for price to extend temporarily and then enters in anticipation of a reversal back toward equilibrium.

The trade outcomes further confirm that the system uses small take-profit targets while allowing trades to remain open for longer periods when price moves temporarily against the position. Since the trade volume remains fixed and does not increase after losses, the strategy does not employ martingale, but it does rely on holding positions until the market retraces. This behavior explains why the win rate remains moderate, yet the system is still able to recover equity over time without rapidly compounding risk. Floating drawdown is therefore a natural part of the system’s structure, reflecting a recovery-based exit methodology rather than fast-cut stop-loss execution.

Another defining component of the strategy is its multi-pair diversification, trading a basket of cross pairs such as EURNZD, EURAUD, AUDNZD, NZDCAD, AUDCAD, EURGBP, GBPAUD, and GBPCAD. These pairs are known for smoother pricing behavior during evening hours, which aligns closely with the system’s timing logic. The relatively low trading activity also suggests that the EA does not take constant entries but instead waits for specific market conditions before executing. Taken together, these elements show that the system is designed for slow, steady, and controlled growth rather than high-frequency or aggressive profit accumulation.

Evening Scalper Pro EA – Final Thoughts

The Evening Scalper All Pairs signal presents a trading approach that prioritizes steady and controlled long-term performance rather than rapid equity acceleration. Its structure, based on night-session mean-reversion scalping with fixed lot sizing and multi-pair diversification, gives it several strengths, including consistent automation, stable execution behavior, selective entry timing, and the ability to operate even with smaller account sizes. The signal’s longevity, operating for more than 192 weeks, further reinforces its reliability and demonstrates that the strategy has been sustainable across shifting market conditions.

At the same time, the system does carry risks that traders must acknowledge. The maximum drawdown of 47.5% shows that floating losses can remain active for extended periods before recovery, and the moderate win rate indicates that profitability does not rely on constant accuracy but rather patience and market correction. The slow growth rate and low trading activity also mean that this strategy may not appeal to users seeking fast or aggressive returns. Therefore, this signal is best suited for traders who value gradual progression, emotional discipline, and consistent automated operation—while understanding that temporary equity dips are part of the system’s behavior.

👉 If you are interested, download it here.

No Comments