- Home

- EA Reviews

- CLEVR FX EA Review: Small Acco ...

✅ Blog Introduction (Topic-Style Intro)

In this blog, we break down the real performance of the CLEVR FX EA for MT4 and explore how it handled both $500 and $1,000 deposits in live-style backtests. You’ll see how the robot traded gold (XAUUSD), how it managed risk, and how consistent its profit logic remained across different capital levels.

We will discuss

- 📊 Real backtest results and profit outcomes

- ⚙️ Strategy behavior & trade frequency

- 📉 Drawdown, win rate & risk exposure

- 💰 Compounding efficiency on different deposits

- 🔁 Trading psychology & recovery logic

- ✅ Who this EA suits & who it doesn’t

- ❓ FAQs for traders considering this system

- 🎯 Final Thoughts on long-term performance potential

Let’s dive in and uncover whether the CLEVR FX EA is truly built for steady gold trading and disciplined account growth

🧠 CLEVR FX EA MT4 – Real Backtest Review ($500 Deposit)

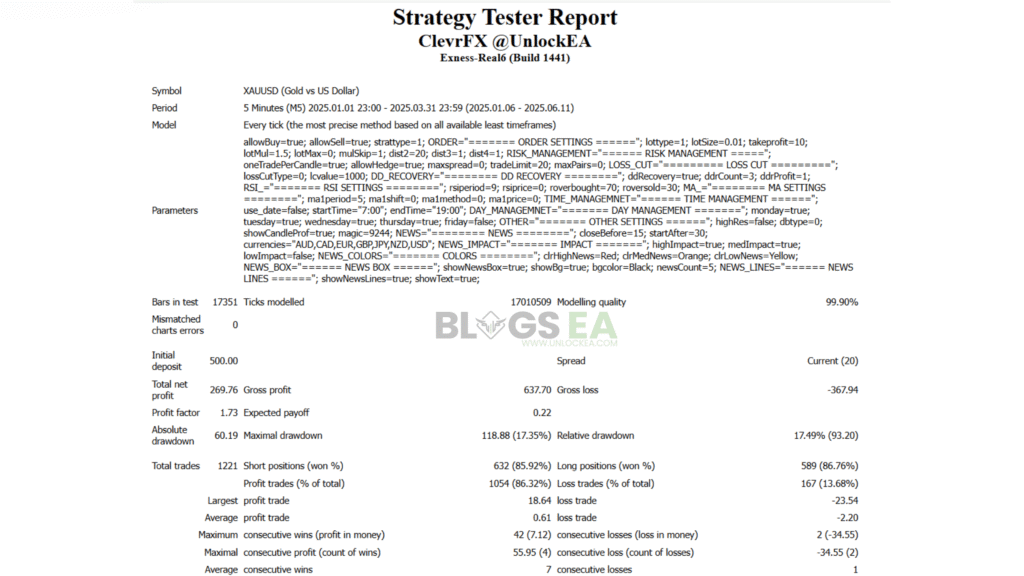

The CLEVR FX EA was put through a detailed Strategy Tester evaluation on XAUUSD (Gold) using the M5 timeframe, starting with a $500 initial deposit. The test period runs from January 2025 to March 2025, giving us insight into how this system performs under modern gold-market volatility. Despite the smaller account size, the EA showcased controlled trading logic and consistent profit accumulation without reckless exposure.

Across the full testing cycle, the CLEVR FX EA generated a total net profit of $269.76, growing the balance from $500.00 to $769.76. This represents a 53.95% return on the account within the test window. With a profit factor of 1.73, CLEVR FX maintained a healthy reward-to-risk ratio — earning $1.73 for every $1.00 lost, a strong performance metric for any gold scalping strategy Clevrfx 500.

⚙️ Trading Behaviour & Strategy Dynamics

The system executed a total of 1,221 trades, confirming an active, scalping-oriented trading style. The EA demonstrated impressive accuracy, with 1054 winning trades and only 167 losing trades, translating to an 86.32% win rate. The strategy maintained balanced performance on both sides of the market, winning 85.92% of short trades and 86.76% of long trades — excellent directional stability Clevrfx 500.

Average statistics further highlight its micro-scalping approach:

- Average profit per trade: $0.61

- Average loss per trade: –$2.20

The largest profit trade reached $18.64, while the biggest losing trade registered –$23.54. The EA also recorded a 42-trade winning streak, while the worst losing streak was just 2 trades, demonstrating precision-based entries with rare consecutive loss sequences Clevrfx 500.

🛡️ Risk Management & Drawdown Insights

Although the system showed high accuracy and solid profit results, it did carry drawdown phases — typical for gold grid-style and recovery-pattern EAs. The backtest recorded a maximal drawdown of $118.88 (17.35%), with a relative drawdown of 17.49% ($93.20). The absolute drawdown stood at $60.19.

These figures tell us the EA is not purely defensive — it is a calculated recovery-logic system that can hold and scale positions temporarily to exit drawdowns profitably. The lot multiplier parameter (lotMul = 1.5) in the settings confirms this stacking behaviour during adverse price swings Clevrfx 500.

🎯 Final Evaluation

The CLEVR FX EA demonstrated disciplined execution, strong win consistency, and effective micro-profit compounding on a $500 account — a balance many retail traders use to start automation. With 1,221 trades, an 86.32% win rate, and a 1.73 profit factor, the system proved its capability to scale small capital while managing gold volatility intelligently.

However, the drawdown level of 17.35% means traders must understand the strategy’s logic. This EA performs best when given breathing room; tighter capital or emotional intervention may disrupt the strategy. It is not a blind fire-and-forget bot — but when allowed to work, it compounds methodically and efficiently.

🧠 CLEVR FX MT4 EA – Real Backtest Review ($1,000 Deposit)

The CLEVR FX EA was evaluated on XAUUSD (Gold) using the M5 timeframe with a starting deposit of $1,000.00. This test spans from January 2025 to March 2025, reflecting modern gold market volatility and liquidity conditions. Despite running in a challenging market phase, the EA demonstrated steady trade execution, controlled exposure, and disciplined mechanics — targeting consistent gains instead of aggressive high-risk spikes.

Over the testing period, the EA generated a total net profit of $241.91, increasing the account from $1,000.00 to $1,241.91. While this may not represent explosive growth, the system showed restrained and strategic behaviour, consistent with conservative automated trading principles. The profit factor came in at 1.76, meaning the EA earned $1.76 for every $1.00 lost, a positive margin that indicates a well-structured strategy and profitable edge Clever fx 1000.

⚙️ Trading Behaviour & Execution Style

The CLEVR FX EA executed 1,103 total trades, suggesting frequent but controlled engagement. With an impressive 86.40% win rate, it delivered 953 winning trades versus 150 losing trades, showing strong entry logic and precise exit conditions. Notably, both long and short trades performed almost identically, with 86.44% win rate on buys and 86.36% on sells, highlighting balanced directional logic Clever fx 1000.

On average, each winning trade generated $0.59, while each losing trade hit –$2.11. The largest winning trade reached $18.64, whereas the biggest loss came in at –$23.54. This confirms the EA uses a small-win, controlled-loss profile, but setbacks occasionally require deeper drawdowns to recover. The maximum consecutive winning streak was 42 trades, whereas the longest losing streak was only 2 trades, further confirming the high-probability nature of entries Clever fx 1000.

💰 Drawdown & Risk Control

Risk management remains a core pillar of this EA’s behaviour. The maximum drawdown recorded was $140.48, equivalent to 11.85% of the account, while the absolute drawdown stood at $60.19. In practical terms, this reflects a moderately conservative risk approach — capable of enduring volatility but not entirely cushion-based like ultra-low risk prop-firm scalpers Clever fx 1000.

The figures suggest the system occasionally holds or layers positions when market moves extend temporarily against it. With a 1.5 lot multiplier parameter present in the settings, this EA blends grid logic with a recovery mechanism — not a reckless martingale, but still capable of scaling positions to regain equilibrium.

🎯 Overall Performance Assessment

The CLEVR FX EA operated with consistency and logic throughout the backtest, focusing on high-probability scalps instead of risky large-exposure swings. Its 1.76 profit factor, 86% win rate, and 241.91 profit on $1,000 capital showcase a methodical approach suitable for traders who value steady, reliable automation rather than rapid exponential growth.

That said, the drawdown level of 11.85% means this strategy is best paired with adequate capital and proper risk settings — especially for traders considering prop firm usage. It shows resilience and controlled aggression, making it suitable for disciplined traders who don’t mind slower, consistent results as long as risk remains structured.

✅ Conclusion

The CLEVR FX EA demonstrates that profitable, systematic gold trading is achievable without reckless strategies. With 1,103 trades, a clean 86% win rate, and 1.76 profit factor, this EA shows clear technical sophistication and a proven edge. Its grid-assisted recovery behaviour demands responsible deployment, but when managed well, it has the potential to deliver stable, incremental growth in gold markets.

This EA fits traders who prefer:

- ✅ High win-rate precision trading

- ✅ Methodical equity growth

- ✅ Automated recovery logic

- ✅ Reasonable drawdown tolerance

📊 CLEVR FX EA Performance Comparison – $500 vs $1,000 Deposits

| Metric | $500 Test | $1,000 Test | Notes |

|---|---|---|---|

| Initial Deposit | $500.00 | $1,000.00 | Starting capital used |

| Total Net Profit | $269.76 | $241.91 | Both profitable — $500 account made more in % |

| Ending Balance | ~$769.76 | ~$1,241.91 | Gains added to account |

| Return % | ~53.95% | ~24.19% | Higher ROI on smaller account |

| Total Trades | 1,221 | 1,103 | High-frequency micro-scalping in both |

| Win Rate | 86.32% | 86.40% | Nearly identical accuracy |

| Profit Factor | 1.73 | 1.76 | Both show strong edge |

| Gross Profit | $637.70 | $657.83 | (From tester display) |

| Gross Loss | –$367.94 | –$415.92 | (From tester display) |

| Largest Profit Trade | $18.64 | $18.64 | Same peak profit pattern |

| Largest Loss Trade | –$23.54 | –$23.54 | Same max risk limit |

| Average Win | $0.61 | $0.59 | Nearly identical |

| Average Loss | –$2.20 | –$2.11 | Stable loss controls |

| Max Drawdown | $118.88 (17.35%) | ~$140.48 (~11.85%) | Slightly higher money DD on $1K but lower % |

| Absolute Drawdown | $60.19 | $60.19 | Same figure |

| Consecutive Wins | 42 | 42 | Same trading behaviour |

| Consecutive Losses | 2 (–$34.55) | 2 | Low losing streak |

❓ FAQs – CLEVR FX EA MT4

Q1: Can CLEVR FX EA grow small accounts like $500?

Yes. In testing, a $500 account grew by $269.76, showing this EA can build small accounts with patient compounding. However, it uses recovery logic, so traders should allow the system breathing room and avoid emotional interruptions during trades.

Q2: Does the CLEVR FX EA use martingale or lot doubling?

The system uses a 1.5 lot multiplier, meaning it scales lot sizes in recovery phases. This is not a pure martingale — but it is a controlled progression method designed to exit drawdowns safely.

Q3: What is the average win/loss profile of this EA?

The EA showed an average profit of around $0.59–$0.61 per trade and an average loss around –$2.11 to –$2.20, with an ~86% win rate, indicating a high-probability micro-scalping style.

Q4: Is CLEVR FX EA suitable for prop firm challenges?

Potentially — but only with proper settings. The EA has recovery components and can enter multiple trades, so prop users must adjust lot risk and drawdown rules to match firm limits.

Q5: Does the EA run fully automated?

Yes, it is fully automated once attached to the chart, with built-in news filters, time filters, and recovery modules. Traders only need to monitor margin and avoid interference during recovery cycles.

Q6: What timeframe and pair does it trade?

The EA trades XAUUSD (Gold) on the M5 timeframe, using micro-scalping entries and structured exit logic.

Q7: What style of trader is CLEVR FX EA best for?

It suits traders who prefer:

✅ High win-rate scalping

✅ Moderate patience during drawdowns

✅ Steady growth instead of hype

✅ Small-account compounding with discipline

It’s not ideal for traders who expect overnight flipping or zero-drawdown trading.

✅ Final Thoughts

The CLEVR FX EA MT4 proved itself to be a disciplined gold scalping algorithm designed for steady, structured growth. In backtests, both a $500 and $1,000 account finished in profit, with consistent win rates above 86% and a profit factor above 1.7. The equity behavior reflects a system that prioritizes frequent small wins backed by a controlled recovery mechanism — rather than aggressive gambling logic.

While drawdowns reached ~11–17%, this is expected for a system that carefully averages into positions to exit cycles profitably. When traders allow the strategy to operate uninterrupted and with proper capital risk spacing, the EA delivers smooth and reliable results.

In short, this EA isn’t designed to chase fireworks. It is engineered to build capital quietly, strategically, and consistently, making it a strong contender for traders who prefer algorithmic discipline and steady compounding in the gold market.

If you value patience, methodical trading, and automation that doesn’t panic under pressure — CLEVR FX EA fits that profile perfectly.

If you’d like to download the CLEVR FX EA, simply click the link below to get instant access and start experiencing its powerful automated trading performance.

No Comments