- Home

- EA Reviews

- Javier Trading Scalper Test: $ ...

✅ Introduction

In this blog, we will take a deep dive into the performance of the Javier Trading Scalper Gold EA, analyzing its behavior on different account balances and evaluating how capital size affects profitability, stability, and drawdown.

We will explore real backtest results using $1,000 and $2,000 deposits, compare equity curves, examine win rates, and study how the EA manages trade cycles in the high-volatility gold market. Whether you’re an automated trading enthusiast or a beginner exploring Expert Advisors, this breakdown will give you clear, practical insight into how this bot performs under real market conditions.

By the end of this blog, you will understand:

- ✅ How the Javier Trading Scalper EA works

- ✅ Backtest results & performance metrics

- ✅ Comparison between $1K vs $2K accounts

- ✅ Risk, drawdown, win rate, and trade logic

- ✅ Common mistakes traders make with EAs

- ✅ Key FAQs to clear trader confusion

- ✅ Final lessons and professional takeaways

Let’s break down the numbers, examine trading behavior, and help you decide whether this EA fits your trading strategy and risk tolerance.

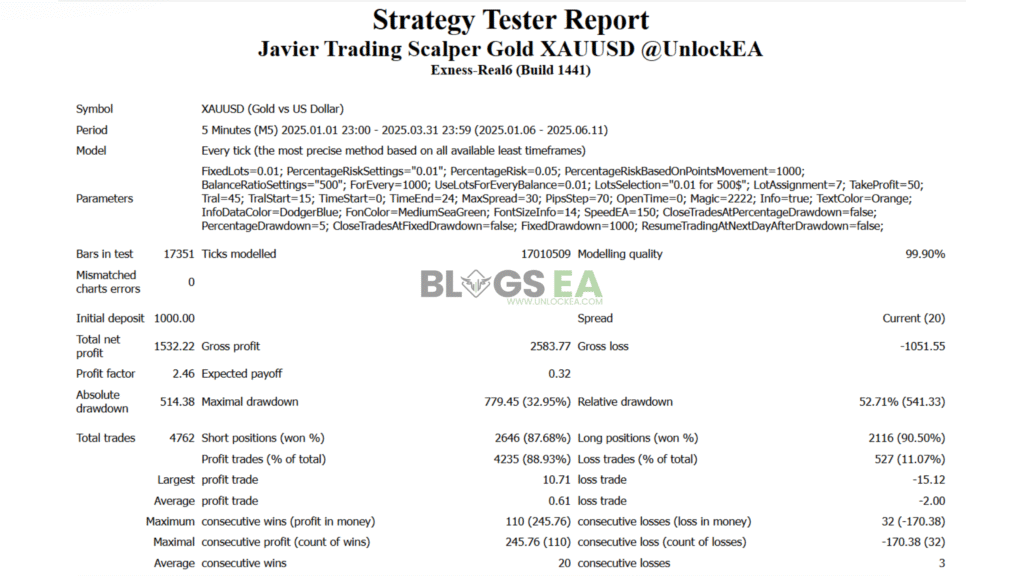

🧠 Javier Trading Scalper Gold EA – $1,000 Backtest Review

Javier Trading Scalper bot was tested on XAUUSD (Gold) using a $1,000 starting deposit, running on the M5 timeframe from January to March 2025. The results reveal how the EA handles aggressive scalping, risk cycles, and high-frequency execution.

💰 Profit Growth Performance

The Javier Trading Scalper EA turned $1,000 into $2,532.22, generating a net profit of $1,532.22. With 4,762 total trades, it clearly operates as a high-frequency scalper, aiming for small repeated gains instead of large swings. The profit factor of 2.46 shows that for every dollar lost, the system earned approximately $2.46 — a healthy profitability ratio for a scalping strategy on gold.

⚙️ How the Bot Trades

Javier Trading Scalper uses a constant 0.01 lot base size, tight take-profits, trailing stops, and a pip-step grid entry logic. It frequently modifies stop-loss levels and locks in micro-profits quickly. This is typical of gold scalping EAs — hundreds of rapid entries, capturing micro-movements with strict stop discipline.

With 88.93% winning trades, the bot prioritizes high win-rate entries, closing trades early once favorable momentum appears. Average profit per trade was $0.61, while average loss was -$2.00, showing small wins but controlled losses — vital in fast gold volatility.

📉 Drawdown & Risk Analysis

Despite strong profitability, the EA faced notable pressure moments:

- Max drawdown: $779.45 (32.95%)

- Relative drawdown: 52.71%

- Absolute drawdown: $514.38

This confirms that while the Javier Trading Scalper EA recovers losses aggressively, it does allow equity dips. In real accounts, this type of stress means the trader must be prepared for volatility and avoid over-leveraging.

⏱️ Trade Behavior

The EA executed 4,762 trades — roughly 1,500 trades per month. Its trade flow shows:

- Short trades win rate: 87.68%

- Long trades win rate: 90.50%

- Max consecutive wins: 110 trades

- Max consecutive losses: 32 trades

This balance suggests trend scalping with recovery sequences, but not reckless martingale. When a string of losses hit, the EA still remained controlled — a key sign of disciplined lot sizing.

📈 Overall Evaluation

This bot shows the characteristics of a structured, rule-based gold scalper:

✅ High win rate

✅ Steady equity growth

✅ Controlled lot sizing (0.01 fixed)

✅ Proven profitable cycle behavior

📊 Javier Trading Scalper Gold EA – $2,000 Backtest Review

The Javier Trading Scalper Gold XAUUSD @UnlockEA expert advisor was tested on Exness-Real6 with a $2,000 starting balance across the period Jan–Mar 2025 (M5 timeframe). The test used every tick modelling with 99.90% quality — meaning these results are highly accurate and detailed javier trading scalper 2000.

Over the test period, the bot produced a net profit of $1,242.01, turning the account from $2,000 to $3,242.01. This represents a 62% growth in roughly three months — an aggressive performance for Gold scalping. The system executed 4,064 trades, with an impressive 89.03% win rate, proving its high-frequency and high-accuracy characteristics javier trading scalper 2000.

⚙️ Trading Logic & Behavior

This EA trades Gold rapidly using 0.01 fixed-lot micro-scalps with small targets and trailing logic. The default Take Profit set was 50 points and trailing started at 15 points, showing that the robot aims for quick momentum bursts rather than long swings. Trades were opened around the clock without time restrictions and managed using tight trailing stops rather than static SL/TP structures javier trading scalper 2000.

A total of 3,618 winning trades vs. 446 losing trades indicates the EA relies on consistent micro-profits to build equity. Average win was $0.57, while the average loss was -$1.86, meaning the EA accepts small drawdowns to chase many tiny profits — common behavior for scalpers javier trading scalper 2000.

📉 Drawdown & Risk Profile

Although profitable, this bot experienced a notable maximum drawdown of $541.33 (26.71%), which is significant for a $2,000 account. In simple terms, the equity once dipped about one-quarter before recovering javier trading scalper 2000.

This shows the EA is profitable but aggressive, and traders must be ready for temporary declines in balance. The largest losing streak reached 28 trades, showing that even high-win-rate systems face difficult market periods javier trading scalper 2000.

✅ What the Results Tell Us

| Metric | Value |

|---|---|

| Starting Balance | $2,000 |

| Ending Balance | $3,242.01 |

| Net Profit | $1,242.01 |

| Win Rate | 89.03% |

| Max Drawdown | 26.71% |

| Total Trades | 4,064 |

| Profit Factor | 2.50 |

This balance curve style and metrics confirm the EA is built for scalp entries, high trade count, tight trailing stops, and persistent micro-gains, suitable for traders who prefer fast growth and can tolerate volatility.

🎯 Conclusion

The Javier Trading Scalper demonstrated a strong and aggressive performance on Gold with a 62% return in ~3 months, backed by precise tick-data modelling. With over 4,000 trades and nearly 90% accuracy, it’s clearly engineered for high-frequency micro-profit scalping.

However, the 26% drawdown means users should run it with sufficient capital, controlled leverage, and risk tolerance. This is not a plug-and-forget EA for low-balance accounts — it’s a powerful tool for traders comfortable with volatility who seek steady compounding through small, consistent gains.

📋 Performance Comparison: $1,000 vs $2,000 Account

| Category | $1,000 Test | $2,000 Test | Summary |

|---|---|---|---|

| Starting Balance | $1,000 | $2,000 | Same strategy, different capital buffers |

| Ending Balance | $2,532.22 | $3,242.01 | Both grew significantly |

| Net Profit | $1,532.22 | $1,242.01 | Smaller account earned more profit in test period |

| Profit % | +153% | +62% | Higher return on smaller capital, but higher risk |

| Total Trades | 4,762 trades | 4,064 trades | Smaller account traded more cycles |

| Win Rate | 88.93% | 89.03% | Almost identical & very high accuracy |

| Profit Factor | 2.46 | 2.50 | Strong profitability on both |

| Max Drawdown | 32.95% | 26.71% | Smaller account experienced heavier drawdown |

| Losing Streak | 32 | 28 | Normal for scalping cycles |

| Lot Size | 0.01 fixed | 0.01 fixed | Same risk logic applied |

| Style | High-frequency Gold scalping | High-frequency Gold scalping | Strategy unchanged |

🧠 Key Takeaway

The EA performed well on both accounts, but:

- Smaller account = higher % returns + more stress

- Larger account = smoother equity + safer cushion

Both tests confirm this is a consistent scalping system, but it benefits from more margin protection.

📊 Grid Comparison: $1,000 vs $2,000 Javier Scalper Results

The chart above highlights how the Javier Trading Scalper EA behaves with different account sizes.

With a $1,000 balance, the bot produced a higher dollar return ($1,532.22) than the $2,000 balance test ($1,242.01). This shows that a smaller capital setup forces the system to cycle trades more aggressively, capturing more micro-scalps during the same period.

However, the $1,000 test also faced higher stress and volatility, hitting a 32.95% drawdown compared to 26.71% drawdown on the $2,000 test. More margin cushion meant smoother equity curves and reduced risk exposure.

Win rates were nearly identical — 88.93% vs 89.03% — proving the EA maintains consistent logic regardless of account size. The key difference lies in risk absorption: larger capital creates safer conditions and smoother performance.

In summary, the bot scales effectively, but bigger deposits mean lower relative drawdown and more breathing room, while smaller deposits produce strong gains yet experience deeper pullbacks.

⚠️ Common Mistakes Traders Make With Scalping EAs

Many traders install a profitable EA and expect magic. But even the best bots require smart deployment. Here are common mistakes to avoid:

❌ Running the bot on high-spread brokers

Scalpers depend on tight spreads — poor execution kills performance.

❌ Under-funding the account

A $200–$300 balance is not enough for a gold scalper — margin exhaustion comes fast.

❌ Shutting the bot too early during drawdown

Scalping strategies recover through cycles — panic stops destroy the edge.

❌ Ignoring VPS & internet stability

One disconnect during volatility can cause trapped orders and losses.

❌ Changing settings without understanding logic

Altering lot size or trailing distance recklessly turns a proven strategy into gambling.

Scalping bots work best with discipline, patience, and stable technical setup.

❓ FAQs Section

Q1: Does the bot work better with higher capital?

Yes. Higher capital reduces relative drawdown and creates safer trade breathing room.

Q2: Can I run this EA on a $500 account?

Technically yes, but not recommended for gold — volatility can eat margin quickly. Best start: $1,000+.

Q3: Does the bot use martingale?

No. It uses fixed lot micro-scalps, trailing logic, and pattern-based entries instead of doubling trades.

Q4: Is this set-and-forget?

Mostly yes — but you must monitor VPS, spreads, and ensure no major execution issues.

Q5: Best broker type for this EA?

ECN-style with low spread + low latency execution.

🎯 Final Thoughts

The Javier Trading Scalper EA has demonstrated consistent, repeatable results across two capital setups. Both backtests show strong win rates near 89% and solid profitability — but they also highlight the importance of margin cushion in aggressive gold trading.

A smaller balance grows faster in percentage terms but suffers more stress. A larger balance grows smoother, safer, and with less emotional load.

For traders looking to automate gold scalping reliably, this bot offers a true high-frequency, micro-profit model — but only when paired with the right capital, VPS stability, and low-spread broker conditions. Success isn’t just about the bot…

It’s about setup, patience, and letting the EA complete its trade cycles.

If you’d like to download the Javier Trading Scalper, simply click the link below to get instant access and start experiencing its powerful automated trading performance.

https://unlockea.com/product/javier-trading-scalper-gold-ea-mt4

No Comments