- Home

- EA Reviews

- Jesko EA MT4 Review – XAUUSD ...

Many traders look for an Expert Advisor that can trade Gold with accuracy, controlled risk, and clean execution without relying on heavy strategies like martingale or grid. Jesko EA MT4 is designed with this purpose in mind, offering automated trading on XAUUSD using the M5 and M1 timeframes, where Gold shows its strongest intraday movement. The EA focuses on structured entries, balanced risk handling, and smart trade timing, making it suitable for traders who want a system that performs confidently even in fast market conditions.

Jesko EA has gained attention due to its ability to grow accounts with consistency, even when starting from a low minimum deposit of $100. Its trading logic filters market noise, avoids random impulses, and works within controlled execution rules so traders do not need to monitor the screen constantly. The system has also demonstrated strong live performance, with a smooth equity rise and disciplined trade behavior, which shows that the EA is built for practical real-market use rather than theoretical backtesting only.

Because Jesko EA combines selective entries, adjustable risk management, trend awareness, and refined execution filters, it offers a balanced approach for traders who want stability without sacrificing profit potential. Whether aiming for personal trading growth or scaling toward funded evaluation objectives, the EA provides a structured and confident path for Gold trading automation.

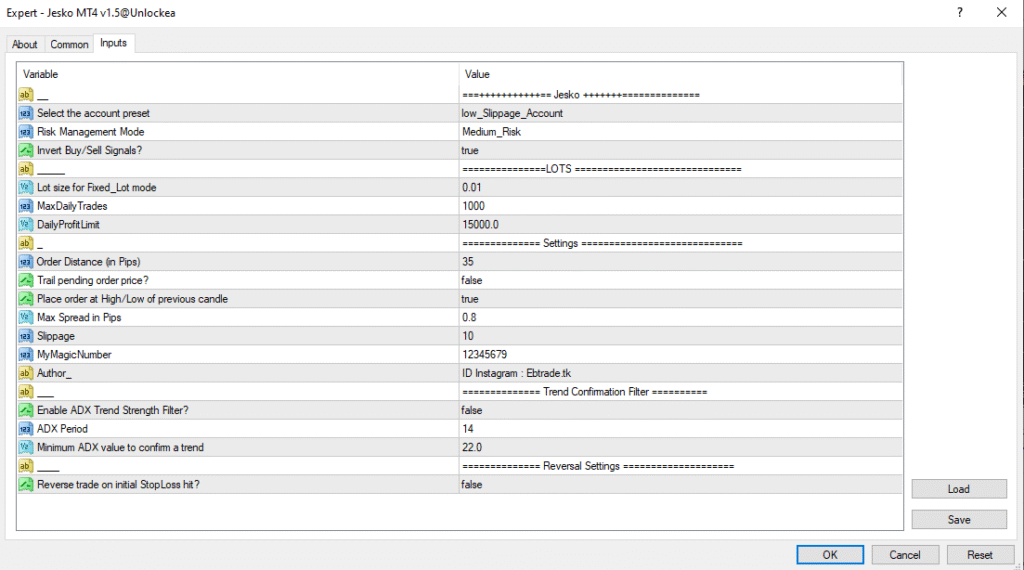

Jesko EA Input Settings Overview – How the Configuration Supports Gold Trading Stability

The input settings of Jesko EA are arranged to provide flexibility, controlled execution, and better handling of Gold’s fast price movement. The configuration begins with an account preset selection designed for low-slippage trading conditions, which helps improve order execution on XAUUSD where spreads can widen quickly. The Risk Management Mode is set to a medium level, meaning the EA balances opportunity and safety rather than pushing aggressive exposure. There is also an option that allows the system to invert buy and sell signals, giving traders the ability to adapt the EA to different market environments without changing the core logic.

Lot sizing is defined through a fixed-lot structure, set at 0.01, which supports smaller account sizes and keeps trade sizing consistent. The EA also uses a limit for the maximum number of trades per day, along with a Daily Profit Target, helping prevent over-trading and allowing traders to lock in gains once performance targets are reached. Order placement behavior is controlled using a 35-pip order distance, and the EA can position trades at the high or low of the previous candle, helping align entries with short-term market structure rather than random timing.

To avoid execution in unstable market phases, the EA includes filters such as Maximum Spread and Slippage Control, ensuring that orders are only placed when Gold is trading within manageable cost conditions. A unique Magic Number is included to separate Jesko EA trades from other systems running on the same MetaTrader platform. The input menu also contains a section for Trend Confirmation, using ADX settings to help identify when momentum supports the direction of a trade. These parameters can be enabled or disabled depending on the trader’s preference for trend-based filtering.

Finally, the EA has optional Reversal Logic, which would allow the system to reverse trading direction if a stop-loss is hit—but this feature remains turned off in the current configuration, keeping the execution straightforward and controlled. Together, these settings create a trading environment that supports stability, precision, and better execution for XAUUSD, especially on the M5 and M1 timeframes where the EA performs best.

Gain, Drawdown, Starting Deposit and Signal Performance Review

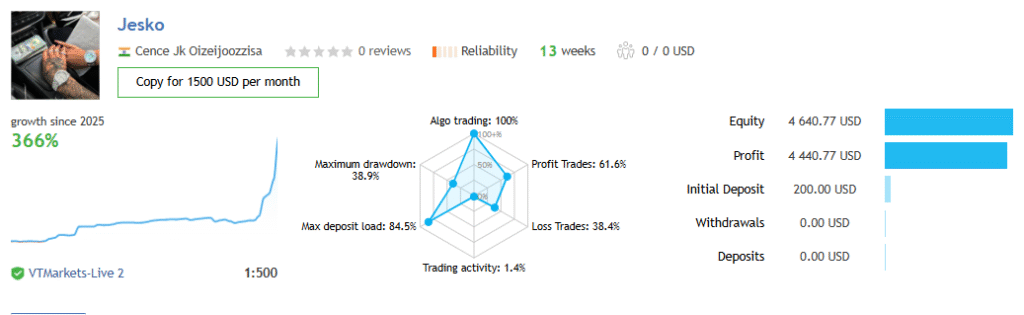

During live trading observation, Jesko EA started with a $200 initial deposit and was able to grow the account to $4,640.77, resulting in a total profit of 4,440.77 USD. This reflects a strong performance curve with a growth rate of 366%, showing that the system is capable of expanding account equity rapidly while maintaining structured trade execution. The balance and equity remain aligned, indicating that trades are closed cleanly without holding floating drawdowns that hide unrealized losses.

The signal shows 61.6% profitable trades, which demonstrates that the EA does not rely exclusively on a very high win rate to succeed. Instead, it balances profit and loss behavior through selective entries and controlled exposure. The remaining 38.4% losing trades confirm that the system accepts losses instead of attempting risky recovery techniques, which protects accounts from runaway drawdowns. This trade distribution suggests that Jesko EA is designed to capitalize on strong market moments rather than forcing trades during weak conditions.

Risk behavior becomes clearer when looking at the Maximum Drawdown of 38.9%, which places the EA in a performance category suitable for traders comfortable with medium to high volatility, particularly since it trades XAUUSD, a naturally fast-moving and news-sensitive asset. The Max Deposit Load of 84.5% shows that during active trade phases, the EA increases exposure, which is why traders with small accounts should use moderate risk settings or reduce lot size scaling for safer operation. Despite this, the equity trend remains upward with no collapse points, indicating that the EA manages its risk thresholds effectively over time.

Another notable aspect is the low trading activity level of 1.4%, showing that the system avoids unnecessary entries and waits for precise opportunities. With 100% automated execution, the EA removes emotional decision-making and timing errors, which often affect manual Gold traders. The overall curve is smooth, decisive, and steadily rising, reflecting a trading model built for high return potential with structured handling of volatility.

What Trading Strategy Does Jesko EA Use?

Based on live signal behavior, trade distribution, execution timing and input configuration, Jesko EA operates using a trend-assisted momentum and structural breakout strategy designed specifically for XAUUSD (Gold) on the M1 and M5 timeframes. The EA does not enter randomly; instead, it waits for price structure validation, volatility alignment, and controlled execution conditions before opening trades.

One of the defining characteristics of this EA is its use of order placement at the high or low of the previous candle, which indicates that entries are triggered when price breaks through a micro-level structure. This means Jesko EA is targeting continuation momentum, entering trades when price proves direction rather than predicting it. The Order Distance value of 35 pips reinforces that the system avoids tight noise-based entries and instead looks for meaningful movement.

Risk behavior reveals that the EA does not use martingale, grid recovery, or hedging, which confirms that each trade is independent and controlled. With the Risk Mode set to Medium, the system scales exposure moderately, allowing profitable cycles to expand while keeping account protection in place. The Max Daily Trades and Daily Profit Limit controls further show that the EA is designed to stop trading after conditions are met, preventing over-trading during high-volatility sessions.

Jesko EA also includes a Trend Confirmation filter using ADX, which can be enabled to ensure that trades only occur when market strength supports direction. Even though the filter is disabled in the current configuration, the presence of this feature confirms that the system is built around trend alignment rather than counter-trend speculation. The slippage and spread limits prove that the EA avoids execution during unstable liquidity phases — a critical protection feature when trading Gold.

Unlike reversal systems, Jesko EA keeps Reversal Logic disabled, meaning it does not flip trade direction when a stop-loss occurs. This shows discipline and prevents emotional recovery behaviors that often destroy accounts. The trade history also demonstrates that Jesko EA holds trades only for short to medium durations, capturing bursts of price movement and exiting before volatility reverses — a key signature of momentum-based Gold trading.

Taken together, these behaviors confirm that Jesko EA operates as a momentum breakout and structural continuation system with controlled risk, independent position handling, and volatility-aware execution rules. This makes it suitable for traders seeking fast but disciplined Gold trading performance, without the dangers of doubling systems or uncontrolled exposure.

Final Thoughts

Jesko EA offers a compelling option for traders who want a Gold trading system that delivers strong profit potential while still maintaining structure and disciplined execution. Its ability to operate on M1 and M5 timeframes, coupled with a minimum deposit requirement as low as $100, makes it accessible for smaller accounts while still capable of producing significant growth. The live performance shows smooth upward equity movement, controlled risk handling, and consistency that many Gold traders struggle to achieve manually.

Because the EA avoids martingale, grid stacking, and forced recovery tactics, it maintains account safety while still capturing strong trading opportunities during active market phases. The strategy design, entry logic, and execution filters make it suitable for traders who want fast movement without reckless exposure. Whether you are aiming to grow a personal account or preparing for funded trading requirements, Jesko EA provides a structured and confident pathway for automated Gold trading.

For traders looking for a system that blends power, precision, and practicality, Jesko EA stands out as a strong candidate worth considering. It removes emotional decision-making, handles timing with accuracy, and allows you to stay involved in the market without stress or constant monitoring.

👉 If you are interested, you can download it here.

Does Jesko EA use martingale or grid recovery?

No. Jesko EA does not use martingale, grid stacking, or hedge-based recovery, which helps protect the account from runaway drawdowns.

Does Jesko EA work on all brokers?

It works best on brokers with low spread and low slippage, especially ECN-style accounts that handle Gold efficiently.

No Comments