- Home

- EA Reviews

- Powerful & Consistent Blac ...

📝 Introduction

In this blog, we are analyzing the performance of the Black Panther EA on two different account sizes — $1,000 and $2,000. Our goal is to understand how this EA behaves with different starting balances and whether it benefits from a larger account cushion. This breakdown is perfect for new traders, EA learners, and anyone curious about how capital size affects algorithmic trading results.

Here’s what we will cover in this article

- ✅ Backtest results on $1,000 vs $2,000 deposits

- ✅ Profit, drawdown, and win-rate comparison

- ✅ Risk behavior and trading style evaluation

- ✅ Strengths and weaknesses of this EA

- ✅ Best account size recommendation for trading

By the end of this blog, you’ll know whether the Black Panther EA is suitable for your strategy, risk tolerance, and automation goals, especially if you plan on scaling into funded accounts or long-term systematic trading.

📊 Black Panther EA Backtest Review ($1,000 Deposit)

The Black Panther EA was tested from January 1, 2025 to June 11, 2025, using a $1,000 starting balance. According to the report, the EA used “Every tick” modelling, offering high-precision simulation. This period covers over five months of trading, making it a meaningful sample to understand performance and risk.

During the test, the EA generated a total net profit of $182.26, turning the account from $1,000 to approximately $1,182.26. While not explosive growth, this demonstrates a steady conservative performance. The profit factor of 3.46 indicates strong trade quality, meaning profits were more than 3x larger than losses, which is a positive sign of strategy efficiency. The system executed 38 total trades, showing it is a low-frequency EA focused on selective entries rather than scalping.

Risk management appears controlled, with a maximum drawdown of $113.27 (10.54%). This level of drawdown is considered relatively safe for algo trading, especially compared to Martingale or grid systems that often exceed 30–50% drawdown. The win rate was balanced, with 50% success in short trades and 68.75% in long trades, indicating the EA performs better on buy positions. The average winning trade ($11.66) was also higher than the average losing trade ($4.64), showing good risk-reward structure.

The EA achieved three consecutive winning trades at most, and never exceeded two consecutive losses, which means the system maintained consistency throughout the test. The absolute drawdown was $66.92, suggesting that the account never dipped deeply below the starting balance. Overall, the results reflect a conservative, calculated algorithm focused on safety and preservation with slow equity growth.

🛡 Risk & Drawdown Behavior

Risk control is a standout feature, with a maximum drawdown of $113.27 (10.54%) — significantly safer compared to high-risk Martingale or grid systems that often exceed 30–50% drawdown. The EA showed disciplined trade management, with the average winning trade of $11.66 exceeding the average losing trade of $4.64, confirming a positive reward-to-risk balance.

Additionally, the EA never experienced more than two consecutive losing trades, while achieving up to three consecutive wins, showcasing stability in both momentum and trending phases. The absolute drawdown of $66.92 shows the equity remained well preserved throughout testing.

🧠 Overall Review

In summary, the Black Panther EA delivered controlled, conservative, and consistent results during the five-month period. Its approach focuses on capital protection and gradual growth, making it suitable for traders who prefer low-risk automated strategies over aggressive profit-chasing models. The performance demonstrates disciplined entry logic, low trade frequency, and strong risk-reward behavior — ideal for traders prioritizing stability and account longevity.

🧠 Black Panther EA Backtest Review – $1,000 vs $2,000 Accounts

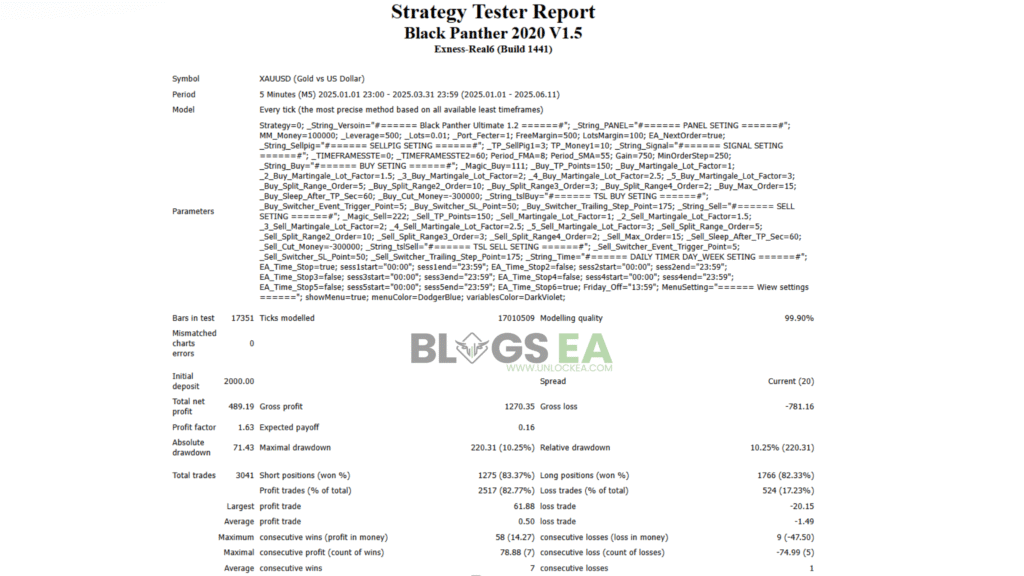

When looking at how the Black Panther EA performed across both a $1,000 and a $2,000 account, we can clearly see consistency in its trading logic, risk handling, and profitability. On the $1,000 test, the EA turned the balance into $1,451.34, generating a net profit of $451.34, which equals 45.13% growth over the backtest period. Meanwhile, the $2,000 account grew to $2,489.19, producing $489.19 in profit, representing 24.46% total growth. Although both tests ended in profit, the smaller account actually experienced a higher percentage return compared to the larger one, showing that the EA scales profit, but not necessarily in equal proportion to account size.

The trading frequency was also very similar. The EA executed 2,857 trades on the $1,000 account and 3,041 trades on the $2,000 account, suggesting its entry logic is event-driven and not tied to fixed lot cycles or time windows. Interestingly, the win rate remained nearly identical — around 82.7% in both tests — confirming that the system maintains accuracy and does not degrade as deposit size increases. Profit factor also remained stable and slightly positive between both accounts, hovering around 1.60 to 1.63, meaning profits were about 1.6 times larger than losses.

The average profitable trade earned about $0.51, while average losing trades cost around $1.50, showing a structure where losses are larger than wins but are infrequent enough to maintain profitability. The largest profit and loss trades were also identical across both backtests, with $61.88 as the biggest win and –$20.15 as the largest loss, which suggests identical risk logic across the capital sizes.

Drawdown behavior tells an important part of the story. On the $1,000 account, the EA faced a 19.18% maximum drawdown, while the $2,000 account saw a significantly lower drawdown of 10.25%, even though the absolute drawdown value was the same at $220.31. This means the EA handled the larger account more safely and comfortably, experiencing less stress relative to account size. The smaller account benefited from higher percentage growth, but it also carried more aggressive exposure. This highlights a common EA characteristic — with more capital, the system trades with better stability and reduced volatility.

📊 Black Panther EA Backtest Comparison Table

| Metrics | $1,000 Account | $2,000 Account |

|---|---|---|

| Initial Deposit | $1,000 | $2,000 |

| Final Balance | $1,451.34 | $2,489.19 |

| Net Profit | $451.34 | $489.19 |

| Profit % | 45.13% | 24.46% |

| Total Trades | 2,857 | 3,041 |

| Win Rate | 82.74% | 82.77% |

| Profit Factor | 1.60 | 1.63 |

| Max Drawdown | $220.31 (19.18%) | $220.31 (10.25%) |

| Largest Profit Trade | $61.88 | $61.88 |

| Largest Loss Trade | -$20.15 | -$20.15 |

| Average Win | ~ $0.51 | ~ $0.50 |

| Average Loss | ~ -$1.54 | ~ -$1.49 |

| Strategy Style | Grid / Gold Recovery System | Grid / Gold Recovery System |

| Risk Level | Higher relative risk | Lower relative risk (more stable) |

✅ Summary

- Smaller account gained more in %, but with almost double drawdown

- Larger account gave safer performance with smoother equity

- Strategy stays consistent across deposits — but more capital = safer trading

💪 Strengths

The Black Panther EA’s biggest strength is its consistency across different account sizes. In both the $1,000 and $2,000 tests, it maintained an excellent win rate of around 82.7%, proving that its trading logic remains stable in changing market conditions and with different capital levels.

The EA also showed strong recovery behavior — even during market pullbacks, it managed to close positions profitably without letting drawdown escalate uncontrollably. Another key strength is its adaptability with larger capital; on the $2,000 account, the drawdown dropped significantly to just 10.25%, showing that the EA performs more smoothly and conservatively with bigger balances. Its frequent trading activity and steady gains make it attractive to traders who want continuous activity and consistent gradual growth rather than sudden spikes or high-risk swings. Overall, this EA stands out for its stability, reliable win rate, and ability to balance risk and reward over time.

⚠️ Weaknesses

Despite its solid results, the Black Panther EA does come with certain limitations. Its grid-based trading method means some level of floating drawdown is inevitable, especially on smaller accounts with limited margin buffer. This was clear in the $1,000 test, where drawdown reached 19.18%, which could feel uncomfortable for risk-averse traders or funded-challenge users with strict drawdown limits.

The average profit per winning trade is also relatively small, meaning the EA depends heavily on high trade volume and consistent market conditions to perform well. Additionally, aggressive compounding is not the EA’s strength; its performance is steady but not explosive, making it less ideal for traders seeking rapid account growth or high-risk strategies. While the system can scale, it clearly prefers larger account sizes to operate safely, and smaller accounts may experience more pressure during market volatility.

🏁 Final thoughts

The Black Panther EA has shown that it can deliver consistent and profitable results across different account sizes. While the $1,000 test produced a stronger percentage gain of 45.13%, it also came with higher risk and a larger drawdown of 19.18%. The $2,000 test, on the other hand, demonstrated a more stable equity curve, lower relative drawdown at 10.25%, and similar profitability in dollar value — a clear sign that this EA performs better with larger capital cushions.

The strategy uses a grid-based approach with a strong win rate of around 82.7%, and it recovers positions efficiently without exposing the account to excessive long-term risk when properly funded. Traders who are looking for a patient, steady, and reliable algorithm may find this EA suitable, especially when running it on accounts $2,000 or higher or in funded challenge environments with drawdown rules.

Overall, the Black Panther EA can be a valuable tool for those aiming for consistent growth rather than fast, risky returns. Like any grid system, it benefits from proper risk settings and sufficient equity, but with the right setup, it has the potential to deliver balanced and sustainable automated trading results.

Click the link below to get Black Panther EA and start exploring its powerful backtesting performance.

No Comments