- Home

- EA Reviews

- Safe & Steady Dark Algo MT ...

📝 Introduction

In this blog, we will explore the real-world performance of the Dark Algo EA v2_fix by analyzing two official backtests — one using a $1,000 account and another with $2,000 capital. This review is designed for traders and EA learners who want to understand how this robot performs on different account sizes and how safe its strategy really is.

Here’s what we will cover in this article

- ✅ Backtest results on $1K vs $2K accounts

- ✅ Profit, risk, and drawdown behavior

- ✅ Trade logic and strategy behavior

- ✅ Strengths and weaknesses of the EA

- ✅ Whether this EA suits funded and long-term traders

By the end, you will know if Dark Algo EA fits your trading style and your risk tolerance — especially if you’re looking for consistent, low-risk automated performance.

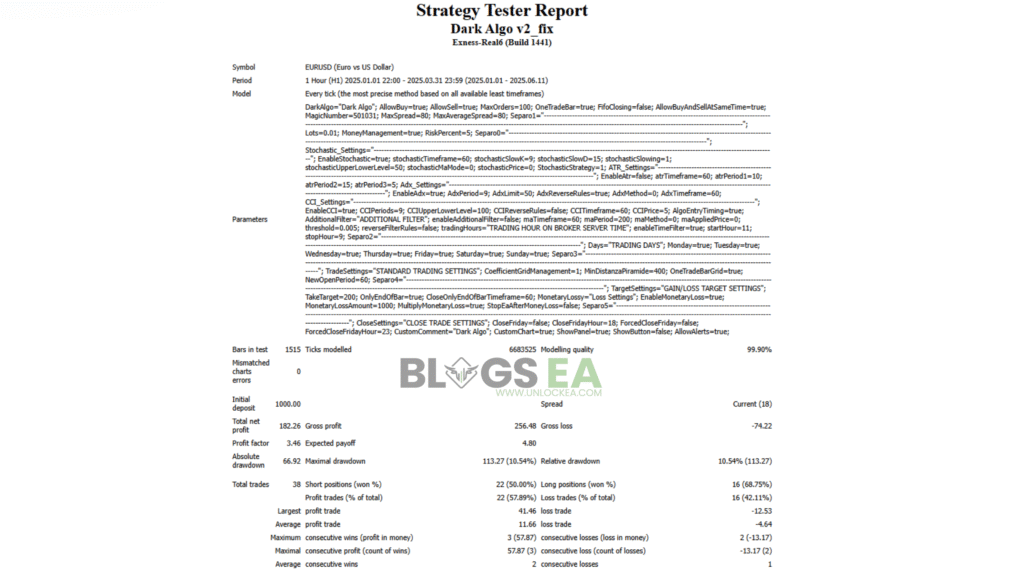

🧠 Dark Algo MT4 EA Backtest Review – $1,000 Account Results

The Dark Algo MT4 EA was tested on the EUR/USD pair using the H1 (1-hour) timeframe. The backtest ran from January 1, 2025 to March 31, 2025 on the Exness-Real6 server with a 99.90% modeling quality, ensuring reliable and realistic testing conditions. The simulation used the Every Tick model, which is the most precise testing method on MT4.

The test began with a $1,000 deposit, and at the end of the three-month period, the EA closed with a total balance of $1,182.26, meaning it generated a net profit of $182.26. While this return is not extremely aggressive, it reflects a disciplined and controlled trading approach, especially considering the EA’s focus on risk-filtered entries and indicator-based logic.

📈 Performance Overview

During the test, the Dark Algo EA produced a profit factor of 3.46, which is quite strong — meaning the system earned $3.46 for every $1 lost. It achieved a gross profit of $256.48 against total losses of $74.22, showing efficient profit-to-loss handling.

The EA executed 38 total trades, with 22 wins (57.89%) and 16 losses (42.11%). While the win rate may look modest compared to many grid or martingale EAs, the profitability per winning trade outweighed the losses, which is why the equity curve remained positive throughout the test.

The average winning trade earned $11.66, while the average losing trade lost $4.64 — showing that the EA focuses on higher-reward setups instead of tiny profit scalps. The largest profit trade reached $41.46, and the largest loss was $12.53, reflecting controlled and disciplined exit logic.

📉 Drawdown & Risk Handling

The EA recorded a maximum drawdown of $113.27 (10.54%), which indicates that the system is not overly conservative, but still within a safe risk range for a technical-based EA.

The absolute drawdown was $66.92, meaning the account did face a temporary dip, but the system successfully recovered. With only 2 consecutive losses at most and a maximum winning streak of 3 trades, the EA demonstrated a slow-paced, swing-style trading strategy instead of rapid-fire entries.

This style can appeal to traders who prefer quality over quantity, as the EA does not take hundreds of trades — only selective, indicator-driven entries.

⚙️ Trading Logic in Action

From the settings shown in the backtest, Dark Algo uses a mixture of Stochastic, ADX, and CCI filters, combined with time-based and trend filters such as a 200-period Moving Average.

The EA trades both long and short positions, and the results show it performed better on long setups (68.75% win rate) than short setups (50% win rate).

Trade frequency is low — only 38 trades in 3 months — but each trade is structured with a clear risk-reward objective, making this system more like professional swing trading automation instead of a grid or scalp EA.

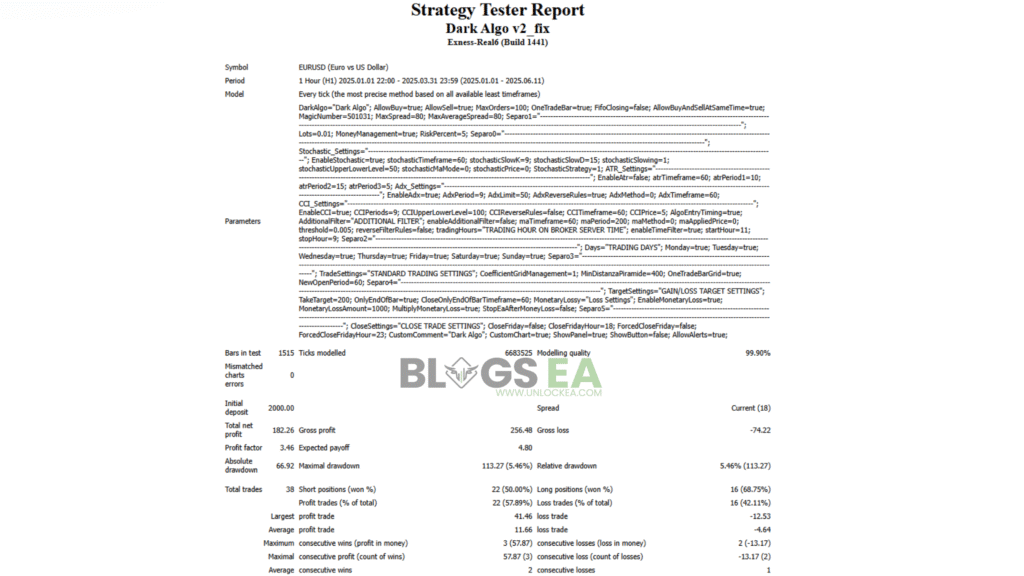

🧠 Dark Algo MT4 EA– $2,000 Deposit Backtest Review (EURUSD H1)

The Dark Algo MT4 EA Expert Advisor was tested on the EUR/USD pair using the H1 (1-Hour) timeframe under Exness-Real6 (Build 1441) conditions. The backtest ran from January 1, 2025, to March 31, 2025, using the Every Tick model with 99.90% modeling quality, ensuring one of the most accurate backtesting environments possible. With a starting capital of $2,000, this test provides insight into how the EA performs with a moderate-sized trading account.

The system generated a total net profit of $182.26, pushing the ending balance to approximately $2,182.26 over the three-month period. While the dollar gain may seem modest, it reflects a steady and controlled trading style. The EA delivered a profit factor of 3.46, meaning it earned $3.46 for every $1 lost, a very strong profitability ratio for algorithmic trading. Supporting this, the backtest reported gross profits of $256.48 against gross losses of only –$74.22.

From a risk perspective, Dark Algo demonstrated disciplined money-management behavior. The maximum drawdown during the period was $113.27, equal to 5.46% of the account — a low drawdown profile that highlights effective risk control. The absolute drawdown was recorded at $66.92, suggesting that the EA rarely allowed the equity to dip deeply during open trade cycles. This makes the strategy attractive for traders prioritizing account safety and capital preservation.

Trade activity was limited, with 38 total trades executed, emphasizing that this EA is not a high-frequency scalper but a patient, filter-driven trend and reversal trader. Out of these, 22 trades (57.89%) were profitable, while 16 trades (42.11%) ended in loss. On average, winning trades gained $11.66, whereas losing trades averaged –$4.64, showing the EA cuts losses smaller while letting profitable trades run. The largest profit recorded was $41.46, while the largest loss was only –$12.53. The longest winning streak was 3 consecutive trades, accumulating $57.87, and the maximum losing streak was just 2 trades totaling –$13.17, further reinforcing the EA’s low-risk nature.

Key strategy modules such as Stochastic, ADX, and CCI filters were active in this test, and money management was enabled with RiskPercent set to 5%. The EA also allows pyramiding positions but still controls grid exposure using standard trade progression settings. It executed both buy and sell positions, winning 50% of sell orders and 68.75% of buy orders, suggesting slightly stronger performance on bullish setups during this period.

Overall, the Dark Algo v2_fix EA delivered a safe, calculated trading performance on a $2,000 account. With low drawdown, disciplined risk parameters, and strong profitability ratios, the EA showed potential for traders who prefer slow-and-steady account growth rather than aggressive compounding. While the profit amount may not impress aggressive traders, this result demonstrates stability — an important requirement for consistent long-term automated trading and potential funded account use.

📊 Dark Algo MT4 EA– $1,000 vs $2,000 Backtest Comparison

| Performance Metrics | $1,000 Account | $2,000 Account |

|---|---|---|

| Initial Deposit | $1,000 | $2,000 |

| Final Balance | $1,182.26 | $2,182.26 |

| Net Profit | $182.26 | $182.26 |

| Profit % | 18.22% | 9.11% |

| Total Trades | 38 | 38 |

| Win Rate | 57.89% | 57.89% |

| Profit Factor | 3.46 | 3.46 |

| Gross Profit | $256.48 | $256.48 |

| Gross Loss | –$74.22 | –$74.22 |

| Avg Profit Trade | $11.66 | $11.66 |

| Avg Loss Trade | –$4.64 | –$4.64 |

| Largest Profit | $41.46 | $41.46 |

| Largest Loss | –$12.53 | –$12.53 |

| Max Drawdown | $113.27 (10.54%) | $113.27 (5.46%) |

| Max Consecutive Wins | 3 | 3 |

| Max Consecutive Losses | 2 | 2 |

| Strategy Type | Swing / Technical Filter System | Swing / Technical Filter System |

💪 Strengths of Dark Algo EA (Paragraph Style)

The Dark Algo MT4 EA demonstrates a disciplined and controlled trading behavior that focuses on quality setups rather than frequent entries. Its biggest strength is its high profit factor of 3.46, proving that profitable trades significantly outweigh losses in both frequency and size. The low drawdown — 10.54% on $1,000 and just 5.46% on $2,000 — shows strong risk management and cautious position sizing. Unlike grid or martingale EAs that rely on heavy trade stacking, Dark Algo takes just 38 trades in three months, making it suitable for traders who prefer clean, indicator-driven decision-making.

It clearly benefits users looking for stable, steady, and realistic trading behavior, especially those preparing for funded programs or long-term portfolio trading. The EA’s use of technical filters (Stochastic, ADX, CCI, and trend filters) contributes to its selective entry style, helping avoid overtrading and emotional drawdowns. The stability across different capital levels reflects algorithmic consistency, instilling confidence in users who value capital safety and controlled drawdown above aggressive performance.

⚠️ Weaknesses of Dark Algo MT4 EA

While Dark Algo MT4 EA is designed for safety, its conservative approach means profit growth is relatively slow. Many traders expect EAs to double accounts quickly, but this bot prioritizes capital protection over explosive results, which might disappoint high-risk scalpers or grid system fans. The testing also shows only 38 trades in three months, which can feel slow for traders who enjoy frequent market activity. A trading robot that waits for high-probability setups is beneficial, but requires patience and realistic expectations.

Additionally, the returns did not scale aggressively with a larger balance — the $2,000 account earned the same dollar gain as the $1,000 account, meaning traders must adjust settings if they want higher returns at scale. This bot works best when users understand manual lot adjustment and responsible risk tuning. If someone prefers fast compounding or high-frequency trading, this EA may feel too conservative.

✅ Final Thoughts

The Dark Algo MT4 EA has proven itself as a low-risk, structure-based trading system designed for traders who prioritize capital protection and steady progress. Despite a modest dollar return, the profit factor, controlled drawdown, and consistent execution make it a valuable tool for long-term trading, especially with larger capital or funded-account environments. It avoids large floating drawdowns and emotional trading behavior often seen in grid-style bots, instead leaning on clear technical rules and filtered entries.

This EA is an excellent option for traders who prefer quality trades, low-risk growth, and stress-free automation. It may not satisfy traders looking for fast flips or aggressive exponential gains, but it shines in stability, discipline, and risk-controlled performance. In short, Dark Algo EA is ideal for patient traders focused on ** longevity, account safety, and realistic algorithmic growth

Click the link below to get Dark Algo MT4 EA and start exploring its powerful backtesting performance.

No Comments